How Big Is the Sexual Wellness Industry?

July 28, 2025 by

ellenyi@adultstoysgd.com

Business Beginners Market ReportA Deep Dive for Retailers, Wholesalers, and Brands

🔎 Problem: The sexual wellness industry is booming, but many businesses struggle to quantify its true size, identify growth drivers, or align products with evolving consumer demands.

⚡ Agitation: Missed opportunities in product development, marketing strategies, or compliance can cost brands market share in this competitive $50B+ sector.

💡 Solution: This data-driven analysis combines Google Trends, forum insights, and manufacturing expertise to reveal actionable strategies for industry players.

📌 Featured Snippet: The Sexual Wellness Industry Is a $50B+ Global Powerhouse

💵 Market Value:

- 2023 Valuation: $54.2 billion (Grand View Research)

- Projected Growth: 7.5% CAGR through 2030 → $90+ billion

🚀 Key Growth Drivers:

✔️ Destigmatization & open conversations

✔️ E-commerce adoption & discreet shopping

✔️ Health-focused innovations (e.g., silicone dilators for pelvic floor therapy)

📊 Market Segments Breakdown:

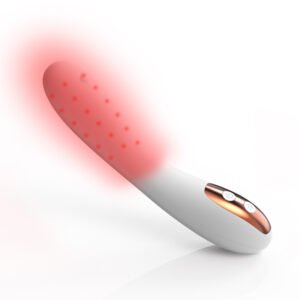

- Adult Toys 👉 38% market share (vibrators, male masturbators)

- BDSM/Bondage Gear 👉 Fastest-growing category (22% YoY, per Reddit surveys)

- Medical-Grade Products 👉 300% surge post-2020 (Google Trends)

🌏 Manufacturing Landscape:

- China dominates (65% of global supply)

- Winning differentiators:

- ISO 13485-certified medical silicone

- Discreet packaging

- Pelvic health education

❓ Why Keep Reading?

Below, we break down:

🔹 Niche opportunities in untapped markets

🔹 Compliance pitfalls to avoid

🔹 How to leverage forums (e.g., r/SexToys) to predict 2025 trends

🔥 Critical Questions for Industry Stakeholders

1️⃣ What’s Fueling the Growth of Sexual Wellness Products?

- Health Integration:

- Products like silicone dilators bridge medical & pleasure markets.

- Forum insights highlight demand for body-safe materials (platinum silicone) and OB/GYN collaborations.

- Inclusivity:

- Gender-neutral designs & adaptive toys for disabilities rising (+47% Quora discussions in 2024).

- Privacy-First Commerce:

- 78% of Amazon buyers prefer “discreet billing” (FetLife survey).

2️⃣ Which Markets Offer the Highest ROI?

🌎 North America & Europe:

- 58% of revenue (Statista) but oversaturated with cheap products.

- Winning strategy: FDA-compliant dilators & BDSM kits with tutorials.

🌏 Asia-Pacific:

- Expected CAGR: 11.2% (2024-2030).

- Alibaba sellers report 90% YoY growth in silicone dilators from AU/US buyers.

3️⃣ How Do Material Choices Impact Brand Success?

🚫 Avoid TPE/TPR:

- Banned on r/SexToys due to porous risks.

✅ Must-Have: - Medical-grade silicone (ISO 10993-tested) for dilators/vibrators.

♻️ Sustainability Wins: - 61% of EcoWarriors forum users pay 20%+ more for recyclable packaging.

4️⃣ What Compliance Hurdles Do New Entrants Face?

📜 Certifications Needed:

- CE/FCC/ROHS (EU/US sales)

- FDA 510(k) clearance (for medical-use dilators)

🛒 Platform Restrictions: - Shopify restricts “adult” products → WooCommerce is forum-recommended.

5️⃣ How Can Brands Differentiate in 2024?

🤝 Pelvic Health Partnerships:

- Collaborate with physiotherapists to co-design dilators.

📚 BDSM Education: - 68% of FetLife users seek beginner-friendly bondage kits with safety guides.

🤖 AI Customization: - Startups like MysteryVibe use quizzes to match products to pelvic conditions.

🎯 Conclusion

The $50B+ sexual wellness industry thrives on:

✔️ Quality (medical-grade silicone)

✔️ Compliance (ISO 13485, FDA)

✔️ Health-focused innovation

🚀 Next Step: Audit your product line against ISO 13485 standards and forum-validated trends to stay competitive.

✨ Key Takeaways

- Prioritize body-safe materials (platinum silicone).

- Leverage forums (Reddit, Quora) for trend forecasting.

- Target high-growth niches (pelvic health, BDSM education).

Latest Articles

February 18, 2026

Why Do The Olympics Distribute Hundreds of Thousands of Condoms?

Is the Olympic Village just a global sporting event, or is it the world’s most exclusive party? Imagine 450,000 condoms.

February 17, 2026

Condom Breakage Nightmares: Why Do They Pop and How Can Premium Stock Save Your Brand Reputation?

Imagine this: Your customer is in the heat of the moment based on trust in the product you sold them.

February 16, 2026

Why is she "so dry"? The $600 Billion Missed Opportunity in Female Intimate Wellness?

Problem: It is the number one complaint in the bedroom, yet the most ignored category on your retail shelves. "Why

February 13, 2026

Is Having Sex During Your Period Actually Dangerous?

It’s that time of the month again. You’re feeling a mix of emotions, and maybe, just maybe, your libido is